While enjoying the best MBA education in China, the 2019 MBA intakes at BiMBA Business School can expect to have extra icing on the cake: up to 70% of full-time MBA and 20% of part-time MBA students will be granted a scholarship. The largesse is made possible by the generous donation of a growing list of foundations and companies, including Fashu Foundation, Mulan Hui Foundation, and Tencent. The scholarships come in various categories and commend accomplishments and contributions in distinctive areas, such as science and technology, public welfare, entrepreneurship, and academics. The top scholarship will cover full academic tuition. The best part at BiMBA, though, is the learning experience with renowned professors and career mentors, as well as access and exposure to an extensive alumni network, comprised of elites from governments, businesses, and academia. BiMBA now operates two MBA programmes: Peking University-UCL MBA and Peking University-Vlerick Business School MBA. As part of NSD and PKU, and by partnering with top international schools, BiMBA is where China meets the world for the making of tomorrow’s business leaders. 2019 BiMBA Scholarship details are below:

2

Alumni Fund in Action

Jan. 17

The board of directors of NSD Alumni Fund held its first meeting of 2019 on January 17th. Ms. Cheng Junhui, secretary general of the Fund, reported that over 4 million yuan of donation was received in 2018, thanks to a higher ratio of alumni making donations. Funding had been earmarked for a wide variety of activities that helped build stronger connections between alumni and NSD. The board of directors had thorough discussions about the work and budget plan for 2019, and suggested to fund ad-hoc researches related to national development, including financing of private enterprises, new policies concerning capital control, and taxation. NSD Dean and Professor Yao Yang commended the work of the Fund and briefed on the academic achievements of NSD and the construction of its new campus called Cheng Ze Garden. At the end of the meeting, two new directors were appointed: Ms. Yu Yi from E12 Class and Ms. Gao Yaping from E16 Class.

3

Shedding Light on Shadow Banking

Jan. 18

Should shadow banking be banned outright? Is financial innovation too dangerous to be good? NSD Dean and Professor Yao Yang called for reflections on the latest bout of policies on banking and financing. He gave the speech at the NSD Policy Talk on January 18th. Banks are now required to shift off-balance sheet activities into balance sheets, and transfer wealth management to asset management firms whose business scope is severely restrained. Besides, other shadow banking businesses have been sharply curtailed, which has led to the abrupt contraction of consumption loans. Such stringent policies have caused the drying up of liquidity in the economy. The downfall of the stock market is partly related to China-US trade war, and certainly has something to do with the inertia of the financial system. Many private enterprises are busy looking for money. Prof. Yao suggested that the local governments should have more funds to work with, including paying civil servants and keeping projects going, by bringing forward the release of ad-hoc bonds as well as having money transfer from the Ministry of Finance ahead of schedule. The Central Bank might find it worthwhile to consider buying the shares or bonds of some firms on the verge of bankruptcy and thus directly inject liquidity into the market. Besides these expedient measures, he advised that the relevant banking and financial authorities should work together to look at the root causes impeding financial innovation and blocking the flow of liquidity, so as to weed out bad policies and keep the good ones.

4

Fintech's Lessons for Belt and Road

Jan. 20

The One Belt One Road initiative was not without controversies and doubts, most of which were baseless, according to NSD Deputy Dean and Professor Huang Yiping in his commentary for Chinese media Caijing.com. But they did reflect our penchant to over-emphasise 'China Story' and under-emphasise the true meaning of 'Win-win Cooperation' in communication with international communities. Chinese fintech companies such as Ant Financial and WeChat Pay might have some inspiring lessons to offer, he said. These companies had built successful partnerships and operations in countries along the Belt and Road and beyond, bringing advanced technologies to truly benefit local residents and economies. And that was done without much direct involvement of the government. Ant Financial opted for strategic investments in a low-profile fashion, i.e. taking minority share and providing technological support. India's Paytm benefited from this kind of cooperation with Ant Financial and saw its users number soar to over 200 million within a year. Prof. Huang said that 'China Story' should be realised through actions – just like the way world-leading Chinese companies won hearts of international partners - and that it's sensible to downplay political factors and focus on benefiting local residents. The government should be there to assist and not to dominate, he said.

5

Uptick in Investor Sentiment

Jan. 21

Image Source: Internet

Chinese stock investors were slightly more upbeat in December 2018, but the overall market confidence was yet to recover, according to the latest reading of China Investors Sentiment Index (CISI) jointly developed by NSD and BAIFENDIAN, a big data and AI solutions company. The December CISI notched 41.4, slightly higher than that of the previous month, but still lower than the January one at 43.2, the peak figure of 2018. The uptick in December was assigned to the improvement of investor sentiment concerning Shanghai Stock Exchange 50 Index and blue-chip stocks. CISI runs from 0 to 100, with the former being the most bearish and the latter the most bullish. The midpoint, 50, indicates neutral mood. The readings in 2018 showed that the investors were more on the pessimistic side. The methodology involves collecting online data and deploys deep learning to measure the sentiment of Chinese retail investors. It incorporates past market info and reflects retail investors' willingness to invest and their expectations for market trends.

About BiMBA MBA at Peking University

BiMBA, established in 1998 by Prof. Justin Yifu Lin (former Chief Economist and Senior Vice President of the World Bank) and his colleagues, is the first Sino-foreign MBA programme in Beijing approved by the Chinese government. It is a joint educational venture between the National School of Development (NSD) at Peking University and its global partners.

As the leading university think-tank in China, the NSD provides BiMBA MBA students with a platform to understand micro-issues from a macro-standpoint and to truly grasp the 'big picture' in management. Together with its university partners, BiMBA is committed to cultivating corporate leaders who are familiar with China's market environment and international business practices and thus empowered with a global vision and a local mindset.

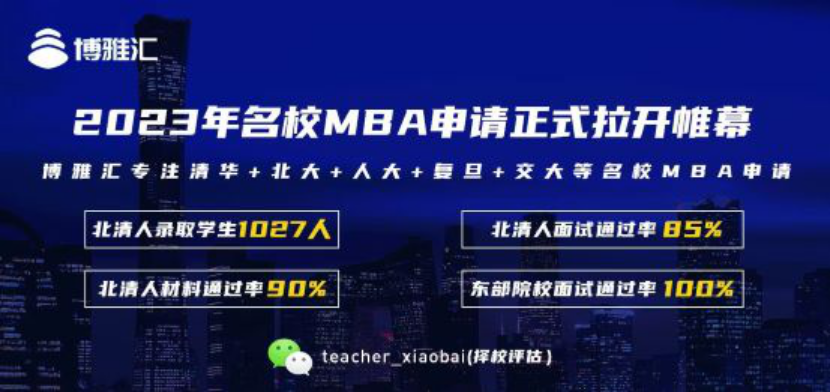

博雅汇MBA,专注于北清人等顶级名校MBA提前面试申请,拥有9年的辅导经验,帮助上千人成功拿到清北人复交等名校预录取资格。